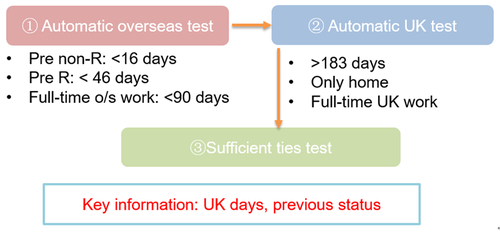

2. Resident status

(1) Automatic overseas test

If satisfied any of the conditions, not a UK resident for the whole tax year.

Condition | In this tax year |

None | <16 days |

Not residence in previous 3 TYs | <46 days |

Works full-time overseas during this TY | <91 days |

(2) Automatic UK test

Individual as UK resident in a tax year if that individual:

• In the UK for 183 days or more during that tax year; or

• Only home in the UK and no home overseas; or

• Works full-time in the UK during that tax year.

(3) Sufficient ties test

Days in the UK | Previously R | Not Previously R |

<16 | NOT R | NOT R |

16 – 45 | R if 4 UK ties | NOT R |

46 – 90 | R if 3 UK ties | R if 4 UK ties |

91 – 120 | R if 2 UK ties | R if 3 UK ties |

121 – 182 | R if 1 UK tie | R if 2 UK ties |

>183 | R | R |

Given in exam

5 Ties

• Spouse/civil partner or minor child in the UK

• Accommodation in UK which is used during tax year

• Substantive work in UK (at least 40 days working at least 3 hours a day)

• In UK for more than 90 days in either of 2 previous tax years

• More time in UK than in any other country in tax year (only relevant if individual was UK resident in any of the previous three tax years)

通关秘钥 -Status 确认三步走